dupage county sales tax calculator

This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7000.

Transportation Logistics And Warehousing Choose Dupage

The Comal County Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 Comal County local sales taxesThe local sales tax consists of a 050 county sales tax.

. As a note the average successful interest rate bid at the Tax Sale held in. The 025 sales tax reduction might not sound like a lot but on a big purchase like a new car or a major repair it could mean. 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected.

The base sales tax rate in DuPage County is 7 7 cents per 100. The base sales tax rate in DuPage County is 7 7 cents per 100. The average sales tax for a state is 509.

Illinois has a 625 statewide sales tax rate but also. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a. The sales tax jurisdiction name is Elgin.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. The current total local sales tax rate in DuPage County IL is 7000. Illinois has 1018 cities counties and special districts that collect a local sales tax in addition to the Illinois state sales taxClick any locality for a full breakdown of local property taxes or visit.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. IL Rates Calculator Table. Buying a Car is Cheaper in DuPage County.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a. 32 states fall above this average and 18 states fall below this average suggesting that the few states with a sales tax of 0 bring down. DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments.

Puerto Rico has a 105 sales tax and Dupage County collects an. This is the total. What is the sales tax rate in Dupage County.

In addition to state and county tax the City of. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The base sales tax rate in DuPage County is 7 7 cents per 100. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special tax. There is also between a 025 and 075 when it comes to county tax.

The tax levies are adopted by each taxing districts board and. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Illinois has a 625 sales tax and Dupage County collects an additional.

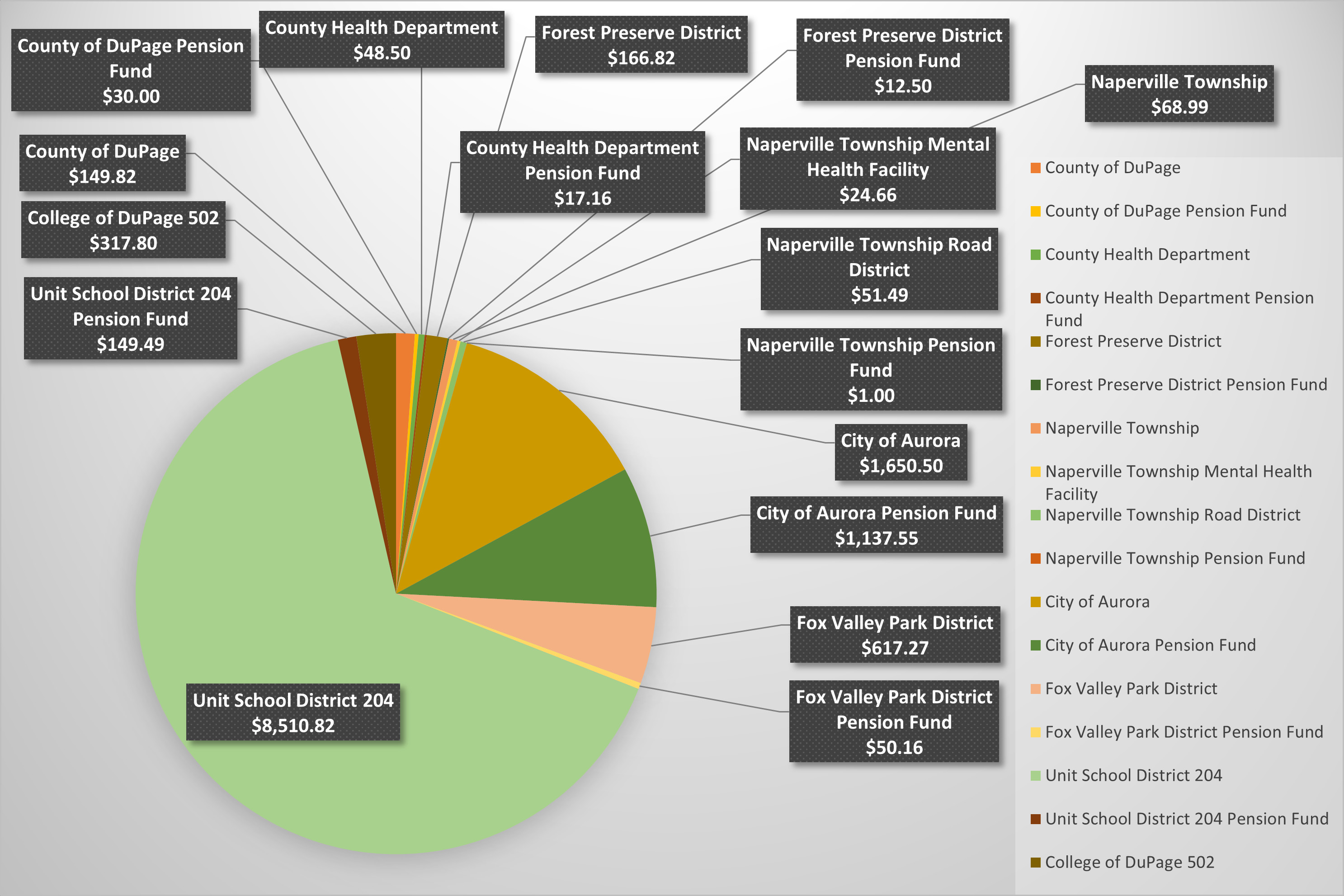

The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County. For comparison the median home value in DuPage County is. The total sales tax rate in any given location can be broken down into state county city and special district rates.

US Sales Tax Rates IL Rates Sales Tax Calculator Sales Tax Table. The total sales tax rate in any given location can be broken down into state county city and special district rates. The December 2020 total local sales tax rate was also 7000.

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Illinois Sales Tax Rate Changes For Certain Municipalities Including Cook And Dupage Counties Effective January 1 2022

Economy In Dupage County Illinois

Property Tax Village Of Carol Stream Il

Dupage County Il Treasurer Sample Tax Bill

Understanding Your Property Tax Bill Bensenville Il Official Website

Referendum Tax Information Fenton Community High School

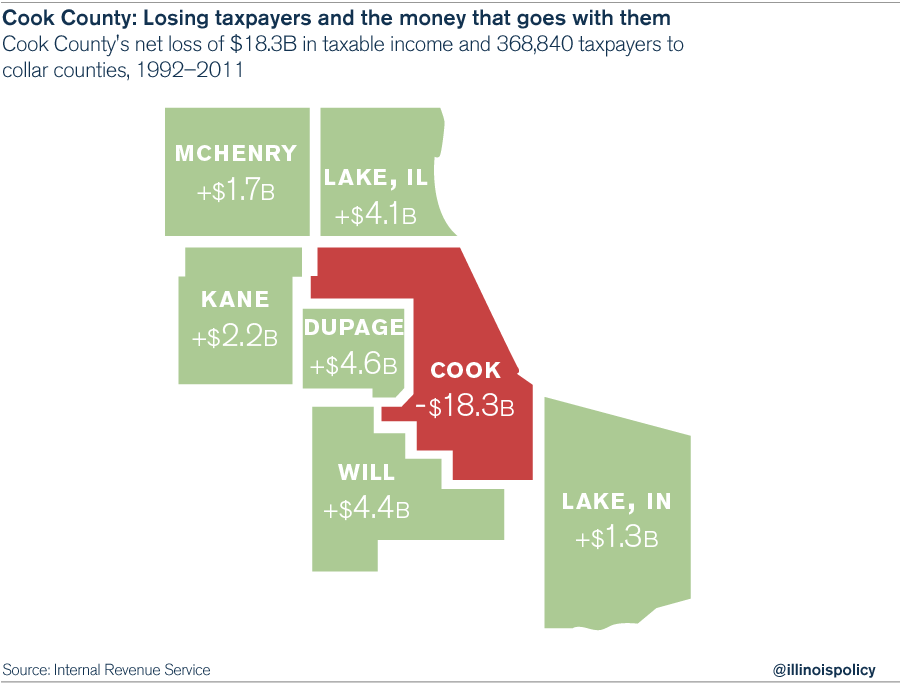

Growing Tax Burden Will Push People Out Of Cook County And Chicago

Cost Of Living In Willowbrook Dupage County Illinois Taxes And Housing Costs

Sales Tax Village Of Carol Stream Il

Aurora Kane County Illinois Sales Tax Rate

Comparing Property Tax Burdens Mchenry County Blog

Real Estate Appraisal Home Appraisal Appraiser Real Estate Appraiser Residential Appraisals Elmwood Park Illinois Citywide Services Chicago Real Estate Appraisers

About Assessor Naperville Township

Illinois Income Tax Increase Calculator How Much Will It Cost You Chicago Tribune

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

North Central Illinois Economic Development Corporation Property Taxes