december child tax credit 2021

This is a 2021 Child Tax Credit payment that may. Eligible families can now apply for a one-time tax rebate to receive.

Child Tax Credit Could A New Senate Proposal Bring 350 Monthly Checks Cnet

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Posted Monday August 22 2022. The taxpayer had not included the payment in income following Notice 2014-7 but did include the amount as earned income in computing an earned income credit under IRC 32 and in computing the refundable child tax credit under IRC 24.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet CCB Payment Dates for 2022. We provide guidance at critical junctures in your personal and professional life. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between the ages of 6 and 17. Browse reviews directions phone numbers and more info on Tax Credits LLC. Tax Credits LLC has handled over 1450 transactions.

It also provided monthly payments from July of 2021 to December of 2021. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest monthly child poverty rate since December 2020. The North Bergen tax collectors office will have extended hours on Friday Aug.

Families will receive the entire 2021 Child Tax Credit that they are eligible for when they file in 2022. However the deadline to apply for the child tax credit payment passed on. The sixth and final advance child tax credit payment of 2021 goes out Dec.

State Tax Credits Tax Credit Consulting Film Tax Credits Tax Credit Placement. Increases the tax credit amount. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. It is not clear whether or not the enhanced credit will be extended into 2022. Ad Tax Strategies that move you closer to your financial goals and objectives.

Claim the full Child Tax Credit on the 2021 tax return. Eligible families have received monthly payments of up. Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6.

Home of the Free Federal Tax Return. 26 for property tax collection. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The office will be open from 8 am. Extended Tax Collector Hours on Aug. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. E-File Directly to the IRS. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit. It is not clear whether or not the enhanced credit will be extended into. The Democrat Senators are trying to.

This means that the total advance payment amount will be made in one December payment. 242 Old New Brunswick Suite 145 Piscataway NJ 08854 45 Knightsbridge Rd Piscataway NJ 08854 Categories. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. The 2021 CTC is different than before in 6 key ways. December 15 2021 830 AM MoneyWatch Monthly Child Tax Credit checks could stop Monthly Child Tax Credit checks set to end if.

The tax collectors office is located in Town Hall 4233 Kennedy Blvd. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the.

Have been a US. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. This includes families who.

December marks the last month that. The remaining 1800 will be. In this case the taxpayer had received a W-2 reporting such a difficulty care payments.

November 10 2022. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. These expanded increased and refundable tax breaks apply for the 2021 tax year and an individual or household can claim both.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB.

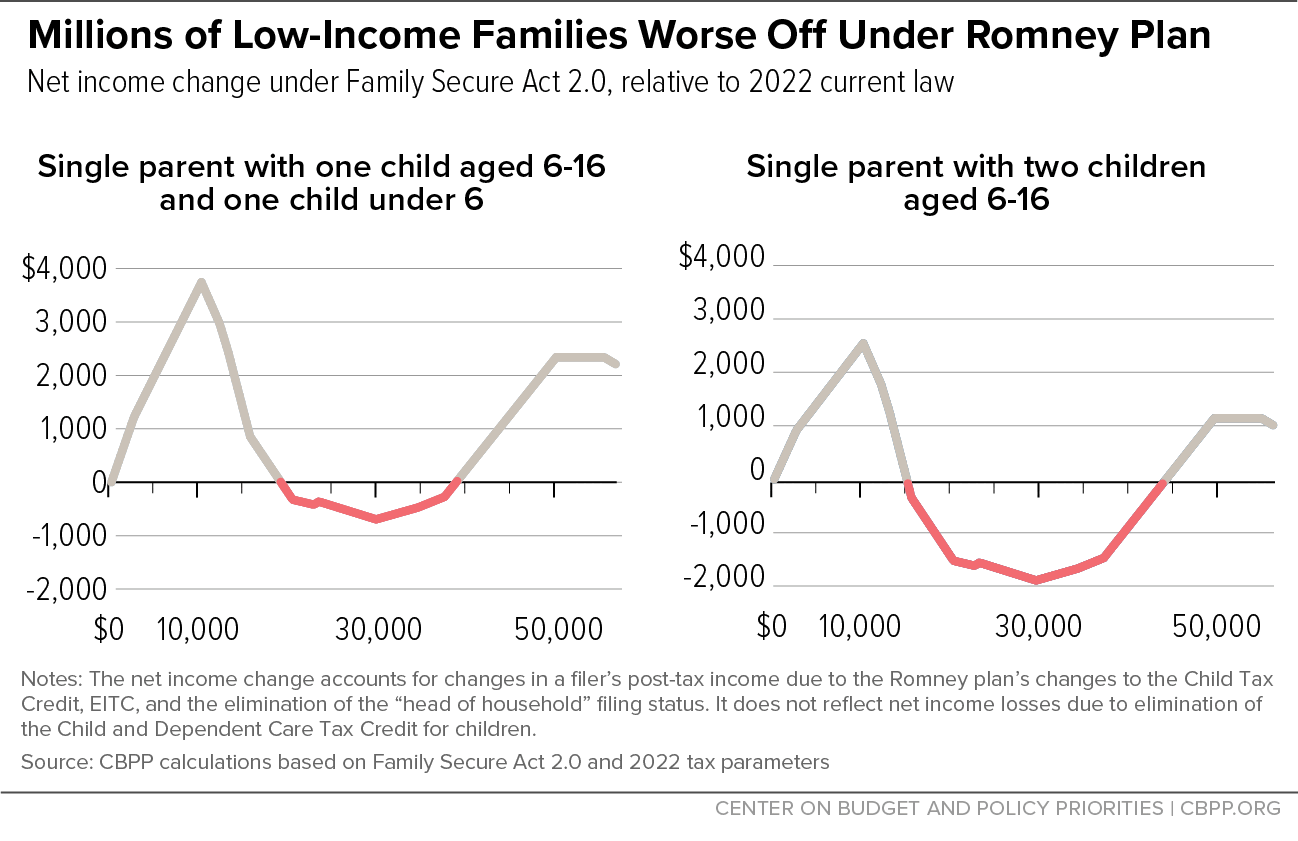

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Where Things Stand With The Monthly Child Tax Credit Payments Npr

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Arizona Families Face First Month Without Child Tax Credit Payments

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Families Are Struggling Financially Without Monthly Child Tax Credit

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Study Millions More Kids Are In Poverty Without The Monthly Child Tax Credit Npr

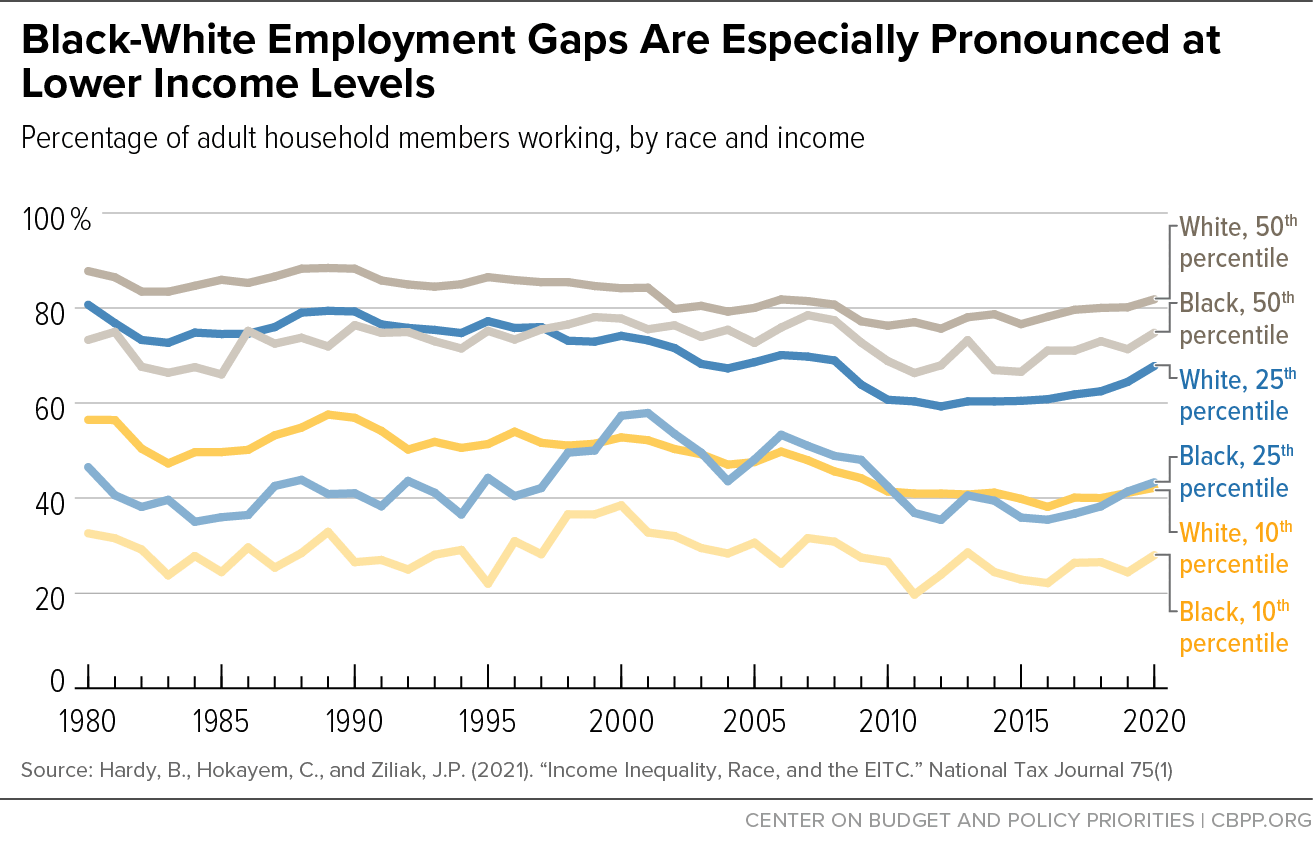

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Study Millions More Kids Are In Poverty Without The Monthly Child Tax Credit Npr

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

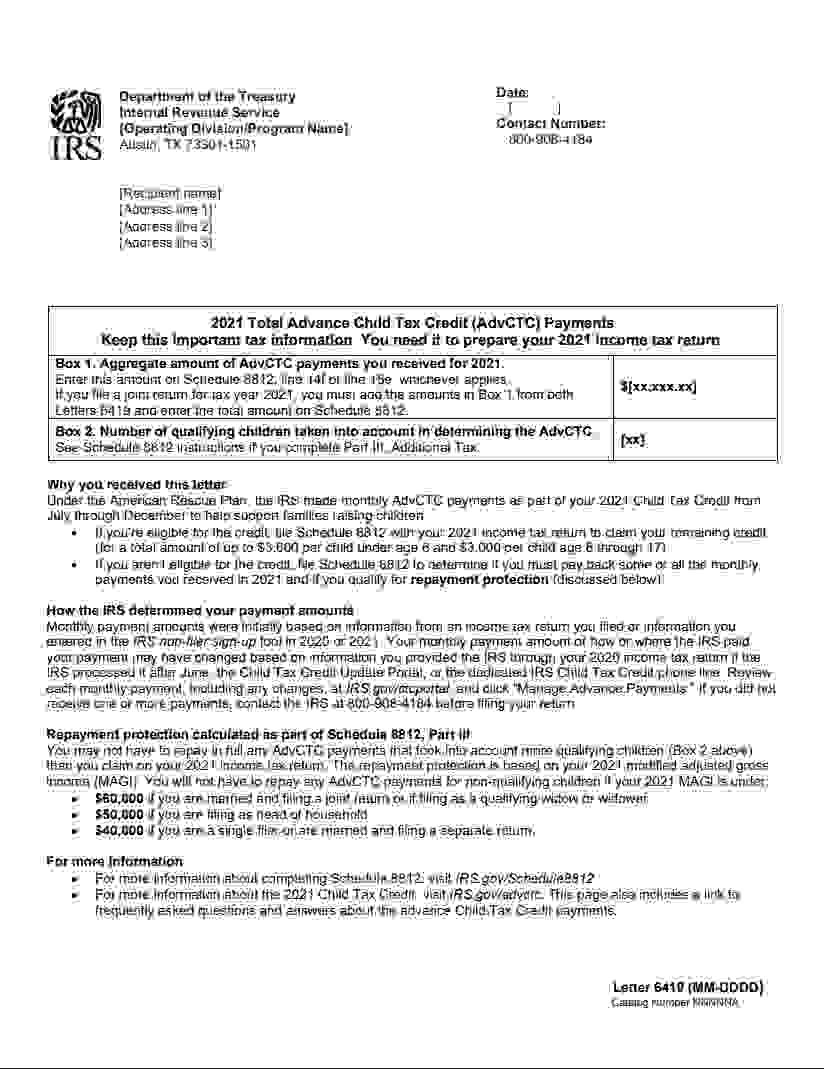

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Did Your Advance Child Tax Credit Payment End Or Change Tas

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Families Are Struggling Financially Without Monthly Child Tax Credit

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

The Future Of The Child Tax Credit Tax Pro Center Intuit

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities